Hardship Assistance Insights suite.

Our Hardship Insights provide critical descriptive analytics to assist in the assessment and review of customer hardship claims using real time data and actual transaction behaviour.

Income patterns are fully interrogated to provide time based insights across all credit areas. Our Net Monthly Position insight can verify changes to income streams including loss of regular income, receipt of Government support payments and other credits. Expense patterns including tightening during periods of hardship are easily identified across fixed and variable areas.

These insights enable a personalised hardship solution to be developed for each customer based on their individual circumstances and financial situation. They can inform decisions for lenders to extend, adjust or exit new and existing hardship programs.

A sample of some of the pre built, out of the box Insights in our Hardship Assistance Analytics Suite are outlined below

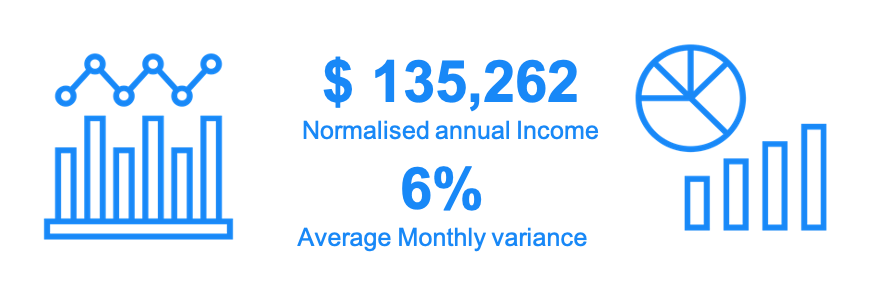

Sample Income Insights

Single consolidated view of multiple applicants, banks, accounts and product data sets

Multiple verified income sources with full trend and pattern analysis

Non regular income analysis

Fully configurable conditional mapping of all income streams

Joint Account income identification and verification

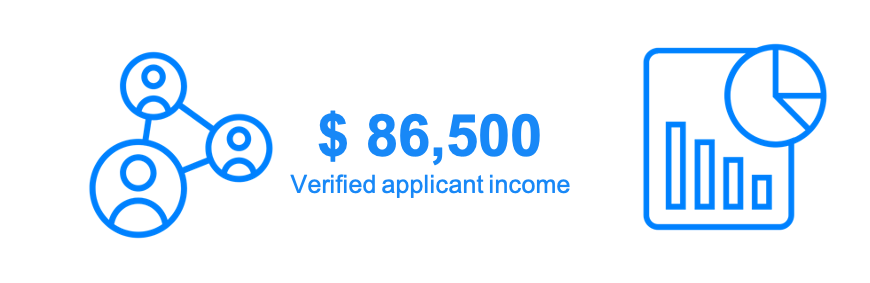

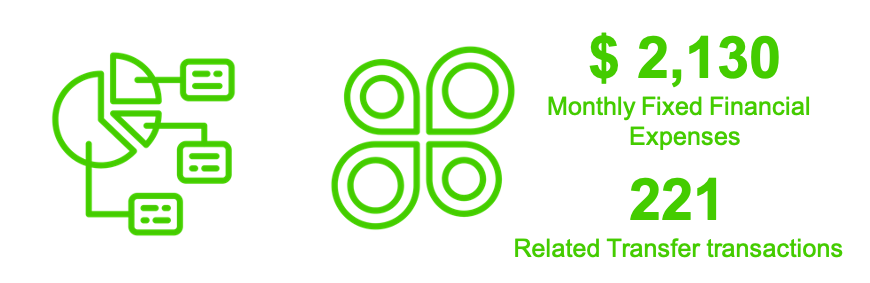

Sample Expense Insights

Full expense analysis including related transfers and de-duplication

Responsible lending red flags with conditional filters

Time based Net Monthly Position / serviceability and affordability

Irregular ‘one off’ payments across all expense areas

Multi recurring expenditure groups with full pattern analysis