Instant decisioning with structured Data Insights.

We enable enterprises to make fully informed customer decisions through descriptive and predictive data insights.

Trusted by:

We’re not a general analytics business.

We are experts in using banking transaction data. Our Insights provide verified data clusters, critical pattern recognition and behavioural indicators to enable more informed decisions against specific business use cases.

From our background in financial services, we are now servicing other verticals where key data insights can be developed to serve a new set of use cases, customer journeys and business outcomes.

From Data to Decisions - Why Insights Matter

Globally, businesses are rapidly adopting data driven decisioning processes across multiple use cases and industry verticals. Consented data exchange journeys coupled with meaningful Insights are now powering an increasing suite of new proactive use cases, unlocking greater business efficiency and increasing bottom line results.

Why should you be considering Data Insights?

More Accurate Business Decisions

Analysing actual customer data rather than relying on historical scores or industry models enables more accuracy and greater personalization.

Quicker Processing Times

Use case specific insights do the heavy lifting for you. ‘Decision Ready Data’ can be delivered in seconds and ‘Time to Decision’ is minimized.

Lower Operational Costs

Greatly reduce costs of origination and take out human error whilst maintaining regulatory obligations and responsible decisioning frameworks.

Improved Customer Experiences

Low friction customer journeys and configurable Insights make straight through processing and instant decisioning a reality.

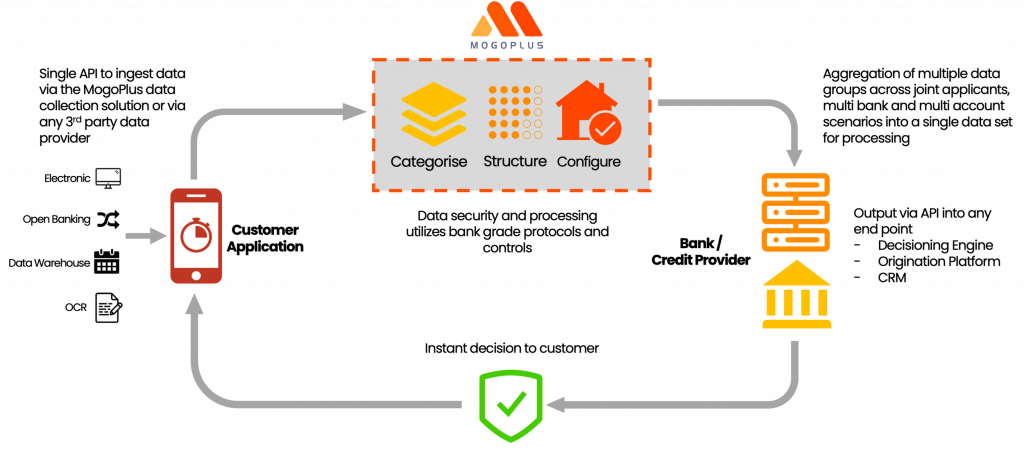

How it works.

The MogoPlus solution uses a single API to collect data from multiple sources. Data is then categorised, aggregated and structured before it passes through one of our product specific configurations for insight generation.

Lending and Credit Insights

Our pre-configured Lending and Credit Insights solutions cover the full range of loan products across the consumer and business customer sectors.

Each configuration provides a unique output and set of descriptive and predictive data points to enable more informed decisioning and risk management processes.

To discover more about the specific Insights provided in each configuration, click on one of the icons below.

Our Customers

MogoPlus Insights are currently powering customer decisioning outcomes for a range of data focused enterprises

Our Partners

The MogoPlus Insights engine is embedded in a number of leading enterprise platforms and SaaS providers.

Our Data Insights are used across a range of verticals, use cases and customer journeys to improve customer experiences, reduce operational costs and manage risk.

MogoPlus and open banking

We have been operating as an accredited open banking provider for over 4 years. We are therefore able to collect and process open banking transaction data for use in our insights and analytics engines

Open Banking Australia

Open Banking UK

Security and Compliance

The MogoPlus platform and Insights engine has been built with the highest available security frameworks and protocols. We use bank grade 3-tier enterprise security solutions. All our frameworks adhere to the following standards and directives:

- ISO 27001 Information Security Management

- PCI-DSS V3.2.1

- GDPR and PSD2

- UK Payment Services Directive

- AU e-Payments Code

- AU Privacy Act