Welcome to the MOGOPLUS bimonthly newsletter of our product, market, industry & tech. trends updates. Keep reading to learn more and please don’t hesitate to contact our team who are more than happy to help.

Product Spotlight

Insights Lite

Key Features Offered

Income Confidence Score

This feature provides valuable insights into the stability of an individual’s income. By assessing the analytical trends of a range of income sources, lenders can confidently write loans to a wider range of applicants including those that sit outside of the traditional PAYG employment space.

Standard Deviation

Assisting lenders in assessing the consistency of earnings and understanding the degree of variation in a borrower’s income over time, therefore identifying potential risks associated with income deviation.

Net Monthly Position

This crucial metric enables lenders to assess whether borrowers can comfortably manage future loan/card repayments by determining the disposable income available to borrowers after accounting for existing commitments.

Streamlining Serviceability Assessments with Meaningful Analytics

Cost, time to decision and accuracy in the credit origination process, are all critical business elements for lenders of all shapes and sizes.

With over 90% of all transactions now in digital format, there is more data available to credit providers than ever before. The challenge is to utilise the right data in the right context for the right purpose. Our Insights Lite solution makes sense of raw, unstructured data with a focus on serving unsecured lending journeys.

Building on our accurate Data Categorisation and Income Verification products, Insights Lite adds further sophistication and utilises additional key analytics and assessment metrics to assist the lender to make more informed and accurate decisions.

Using a low touch, configurable solution, unique algorithms, analytical modules and other income focused statistical calculations, our Insights Lite product creates a consistent, coherent, and intuitive output with decision-ready metrics to help accelerate the lending decisioning and enable straight-through processing.

The Insights Lite product streamlines affordability assessments for personal loans, auto loans and credit cards. This enables lenders to make informed lending decisions faster and with higher levels of accuracy.

Key Highlights & Benefits

- Unique cross point between customer-centric and data-driven decisions. This helps lenders to identify inconsistencies, examine deviations and recognise credit transaction peaks and troughs.

- Quicker off-the-shelf rule based income scoring.

- Enables financial institutions to reduce their operational costs with decision ready data metrics.

- Streamlines affordability assessments, assisting informed lending decisions, personalised offers, and reduced defaults whilst also promoting responsible lending.

- Eliminates the need for paper based bank statements and manual forms for income and expense declarations – provides an automated and secured way to streamline customer’s lending journeys and achieve straight-through-processing.

For more information on our Insights Lite product, please reach out to us via info@mogoplus.com

Latest Developments and Enhancements

Open Banking Developments

We have recently released Open Banking API version 2.0 for our Go Cat product. This latest version introduces several new features, including the ability to enable multi-applicants within a single workflow. This enhancement significantly reduces the complexity of the application process, providing a smoother user experience. We’ve made further enhancements in the product configuration, resulting in a streamlined project setup and delivery process. This represents a significant leap forward in our journey toward scaling up our operations.

Platform Enhancements

We've made significant progress in optimising our platform consumption, resulting in a 25% reduction in costs. Despite this substantial cost-saving achievement, we are proud to announce that we've maintained the stability and reliability of our platform.

Industry Headlines

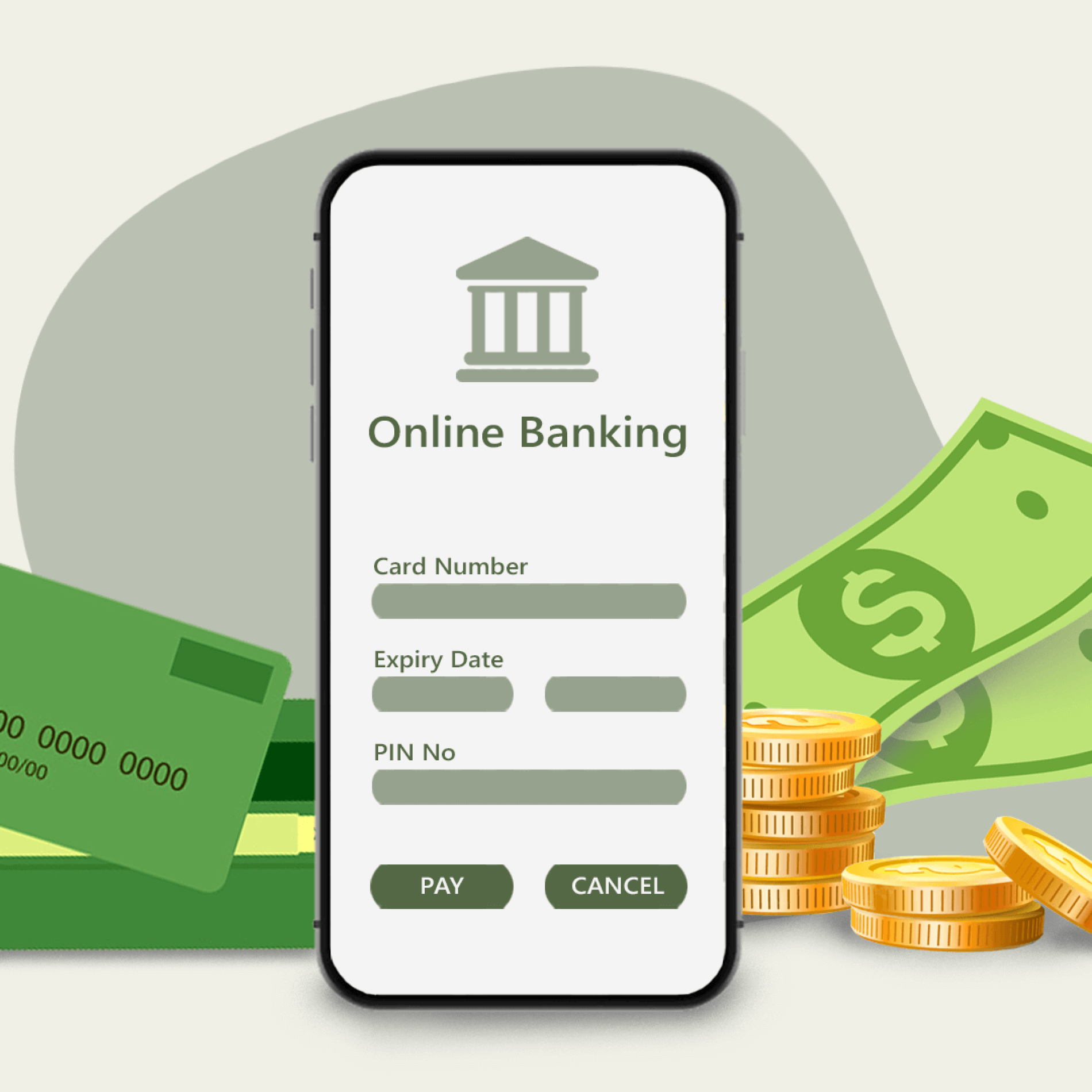

Arrears to rise as repayments outpace income growth: Moody’s

Moody’s Investor Service’s latest data on residential mortgage-backed securities (RMBS) has revealed the rate of mortgages in arrears is set to rise throughout the year as mortgage repayments have “significantly outpaced income growth”. |

"Rising equity increases the likelihood that borrowers in financial difficulty will be able to refinance their loans or sell their properties at high enough prices to repay debts"

Tips and Reminders

Wanted to keep track of our release date?

For every major upgrade, we ensure to post our release date on both the Customer Portal and MOGOPLUS Dashboard.

Simply visit either of these platforms to stay updated.

Copyright (C) 2024 MOGOPLUS. All rights reserved.