Home Loan Insights suite.

Our Home Lending Decisioning Insights cover the full spectrum of Income, Expense and Liability data across both single and joint accounts.

Our full income module is included covering multiple credit sources and employment types, all of which can be configured to the specific needs of each lender we work with. A range of pre-built conditional expense insights are also included covering behavioural based indicators across fixed and variable debit groups and key responsible lending areas.

We enable any combination of data sets from multiple applicants, multiple institutions and multiple accounts to be combined seamlessly into a single set of decisioning insights for quicker and more efficient processing outcomes.

A sample of some of the pre built, out of the box Insights in our Home Lending Analytics Suite are outlined below

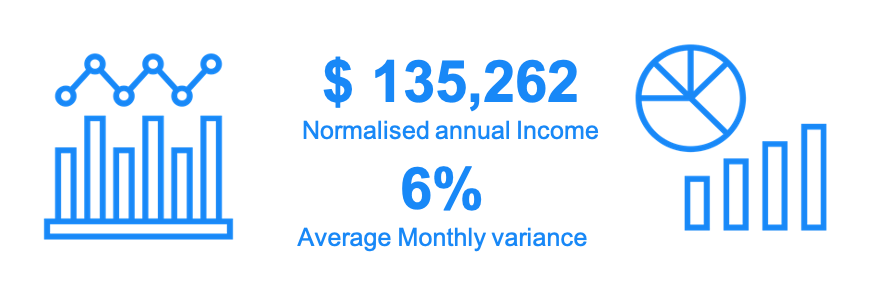

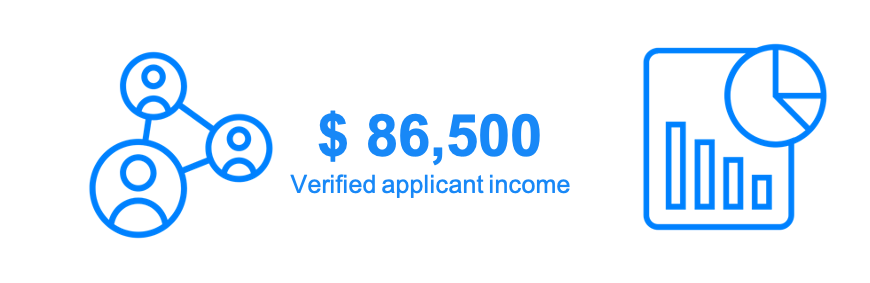

Sample Income Insights

Multiple verified income sources with full trend and pattern analysis

Dynamic Credits – Frequencies and Ratios.

Single consolidated view of multiple applicants, banks, accounts and product data sets.

Non regular income analysis

Fully configurable conditional mapping of all income streams

‘Time since last’ Insight across all income and credit groups

Joint Account income identification and verification

Stability, frequency and reliability of all credit sources

Sample Expense Insights

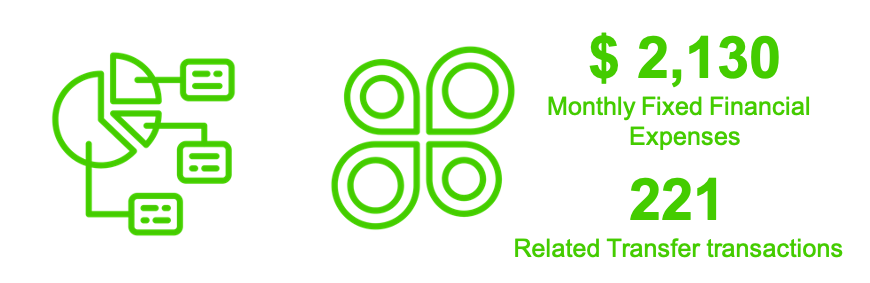

Full expense analysis including related transfers and de-duplication

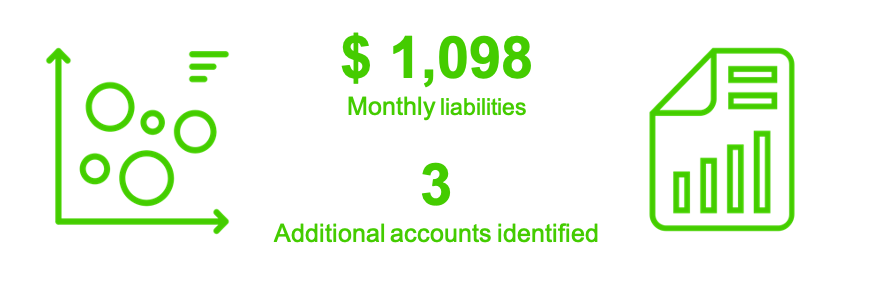

Undisclosed liabilities and other accounts

Multi recurring expenditure groups with full pattern analysis

Responsible lending red flags with conditional filters

Time based Net Monthly Position / serviceability and affordability

Irregular ‘one off’ payments across all expense areas