Buy Now Pay Later Insights suite.

Our Buy Now Pay Later insight suite enables accurate and instant verification and assessment of an applicant’s financial situation without many of the more detailed analytics used in higher risk credit products.

This configuration includes recognition of multiple income streams, full behavioural analysis of both fixed and variable expense trends as well as a rolling monthly surplus (serviceability) score.

Additional insights include our full responsible lending module with identification and conditional mapping of a variety of transaction groups including undisclosed liabilities, pay day loans, other BNPL accounts and gambling.

A sample of some of the pre built, out of the box Insights in our Buy Now Pay Later Analytics Suite are outlined below

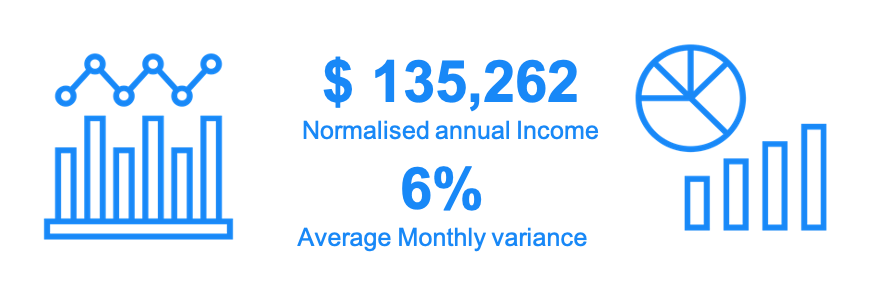

Sample Income Insights

Multiple verified income sources with full trend and pattern analysis

Non regular income analysis

‘Time since last’ Insight across all income and credit groups

Stability, frequency and reliability of all credit sources

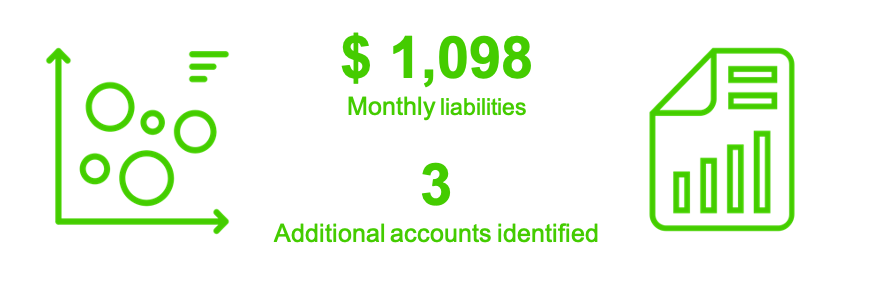

Sample Expense Insights

Undisclosed liabilities and other accounts

Responsible lending red flags with conditional filters

Time based Net Monthly Position / serviceability and affordability

Irregular ‘one off’ payments across all expense areas