Business Lending Insights suite.

Our Business Lending Decisioning Insight suite has been developed specifically for accurate assessment of business transaction data in relation to lending decisions.

This configuration covers multiple business revenue streams including POS credits, invoice revenues, tax refunds and grants. Relational and conditional insights are applied to all revenue sources. A range of pre-built conditional expense insights are also included covering behavioural based indicators across fixed costs, inventory expenses, payroll, superannuation and taxes.

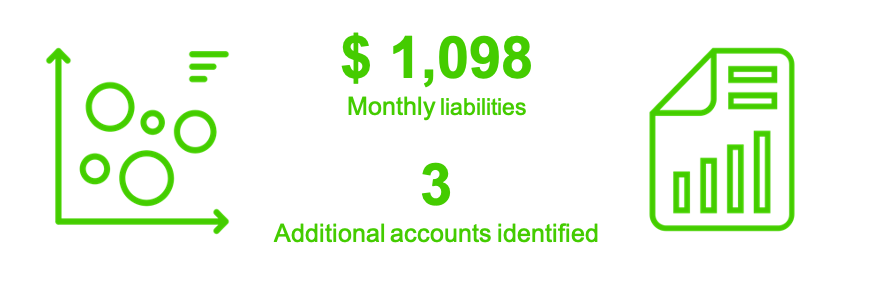

Other liabilities are also identified and can be mapped against a range of other data sets and configured to the exact needs of the lenders decisioning criteria. Our Net Monthly Business Surplus Insight can identify cash flow peaks and troughs over long periods and indicate where additional lines of credit may be offered.

A sample of some of the pre built, out of the box Insights in our Business Lending Analytics Suite are outlined below

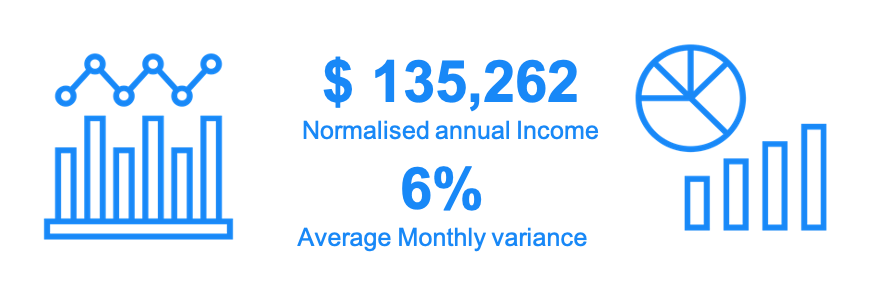

Sample Income Insights

Multiple verified revenue sources with full trend and pattern analysis

Dynamic Credits – Frequencies and Ratios.

Non regular revenue analysis

Fully configurable conditional mapping of all revenue streams

Stability, frequency and reliability of all credit sources

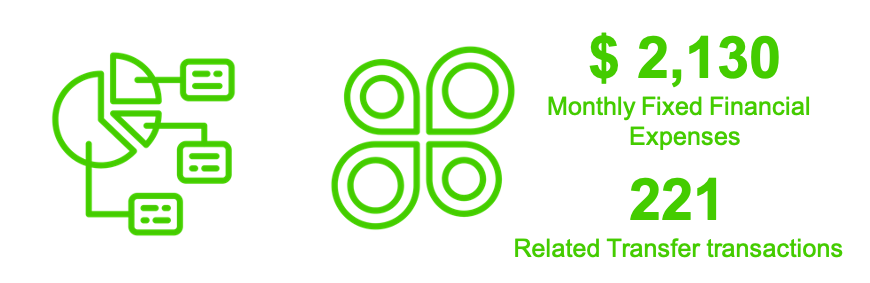

Sample Expense Insights

Full expense analysis including related transfers and de-duplication

Undisclosed liabilities and other accounts

Multi recurring expenditure groups with full pattern analysis

Time based Net Monthly Position / serviceability and affordability

Irregular ‘one off’ payments across all expense areas