Happy New Year everyone! We’re thrilled to kick off the year with our latest newsletter. We’ll dive into the latest MOGOPLUS Product Spotlight, as well as market, industry, and tech trends that are shaping the landscape. Stay informed with inspired, insightful updates, ensuring you’re at the forefront of innovation in the decisioning insights and analytics space.

MogoPlus Product Highlight

Verification of employment is central to the lending and credit market. Reviewing bank statements and pay slips manually to verify an applicant’s income can be a frustrating and a highly time-consuming task for credit teams. It is also prone to fraud, inaccuracy, and human error.

MOGOPLUS’ Income Verification Product enables credit assessment and underwriting teams to instantly determine current and recent income and employment information automatically using actual and verifiable transaction data.

Our Income Verification Product is enabled by the MOGOPLUS income analytics engine which has been processing Australian income data for over 10 years across all lending products. It provides quick and accurate income profiling that verifies compensation for salaried, part-time and gig economy workers by collecting data directly from primary sources – applicant’s online accounts.

Aggregation of multiple income streams and specific configurable rules based on income frequency, recency and reliability are all included in the solution. With the highest level of accuracy in the market, our Income Verification product is used as the engine room for providing instant-decisioning and straight-through-processing outcomes for many innovative banks and lenders.

This eliminates the time-consuming process of bank statement analysis, providing an automated calculation of qualifying income that can be used to assess a credit application.

Key Features

Accurately assess and verify all types of employment data.

Provide instant Income Verification confirming payroll and non-payroll compensation.

Insightful Analytics leveraging recency, regularity and reliability of credits and meaningful pattern recognition.

Lender Benefits

Accelerate your approvals and streamline your underwriting with automated Income Verification

Reduce your risk, and your manual load, with instant employment verification.

Leverage real-time income and employment data to write more loans.

Get accurate and cost-effective employment verification to grow your loan book.

Achieve instant-decisioning.

To find out more about the comprehensive and accurate product for income and employment verification, and more please reach out to info@mogoplus.com

Recent Updates & Enhancements

Functional Improvements

We have implemented enhanced logging functionalities for the Data-Capture application, enabling more comprehensive and detailed traceability of the application journey. This enhancement provides deeper insights into each stage of the application process, facilitating better monitoring, analysis, and troubleshooting.

Additionally, we have designed and implemented a robust performance test suite. This suite can be executed either on a scheduled basis or upon request, offering flexibility in assessing the system’s performance. The test suite provides accurate benchmarks and measurements, optimising the application’s performance to meet Service Level Agreements (SLA) more effectively.

Platform Enhancement

We’re thrilled to announce that we’ve upgraded our technology to the latest version of Kubernetes. Get ready for enhanced performance, new features, and unparalleled stability as we propel our systems into the future!

Industry Headlines

Hardship support not up to scratch

The latest Rank the Banks report from Financial Counselling Australia reveals that the majority of lenders in the Australian consumer credit market are failing to provide appropriate hardship support for customers.

The report, based on a survey of over 400 financial counsellors, highlights concerns about lenders’ poor performance in dealing with hardship cases…

Lenders not picking up early signs of financial stress

Nearly a quarter of lenders wouldn’t know if a customer was in financial stress unless a borrower were to reach out, according to new findings from credit agency Experian. For more than half, meanwhile, the first sign that a borrower is struggling to meet their commitments would be a missed repayment.

Our MOGOPLUS Suite of Hardship solutions can assist lenders to provide better and more personalised vulnerability solutions.

Tips and Reminders

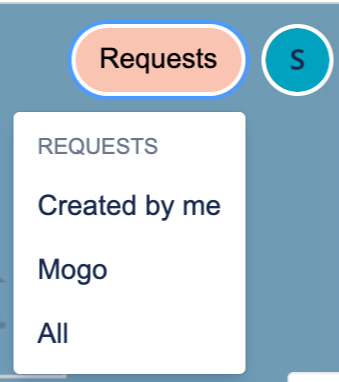

Interested in reviewing the tickets that you or your team have raised with MOGOPLUS Jira Service Desk?

Users have comprehensive ticket management via the MOGOPLUS Jira Service Desk – Customer Portal

Tickets raised by the individual as well as those raised company-wide, both currently open and previously closed can be reviewed and managed by the User – see screenshots below.

Ticket traceability is provided regardless of whether raised by email jira.support@mogoplus.com or Customer Portal

Copyright (C) 2024 MOGOPLUS. All rights reserved.

Our mailing address is:

Want to change how you receive these emails?

You can contact us via newsletter@mogoplus.com or unsubscribe